Payroll Compliance

Payroll Compliance Services That Keep Your Business Risk-Free

Managing payroll compliance in India is complex, with ever-changing statutory requirements and strict deadlines. A single error in payroll compliance can lead to penalties, employee dissatisfaction, and legal risks. At CPS LLP Consultant, we simplify the process by ensuring your payroll is fully compliant, accurate, and hassle-free – so you can focus on running your business.

What We take Care Of

Employee's Provident Fund Act

ESIC Act

Factory Act

Contract Labour Act

Shop & Establishment Act

Professional tax Act

Maharashtra Labour Welfare Fund Act

Computerised Payroll Preparation

Labour Licenses

Why Choose Our Payroll Service

Stay Litigation-Free

Avoid costly disputes and penalties by ensuring complete payroll compliance with labour laws, statutory filings, and regulatory requirements.

On-Time Compliance

We manage payroll deadlines with precision, handling PF, ESI, PT, TDS, and other statutory filings to keep your business penalty-free.

Cost-Effective HR

Reduce administrative overheads and streamline payroll processes, saving time and money while improving compliance accuracy.

Expert Guidance

Get authoritative support on complex labour laws, wage codes, and statutory payroll matters with 20 years of compliance expertise.

Employer Control

Maintain full visibility and authority over payroll operations with audit-ready reports, compliance dashboards, and real-time updates.

Frequently Asked Questions About Payroll Compliance

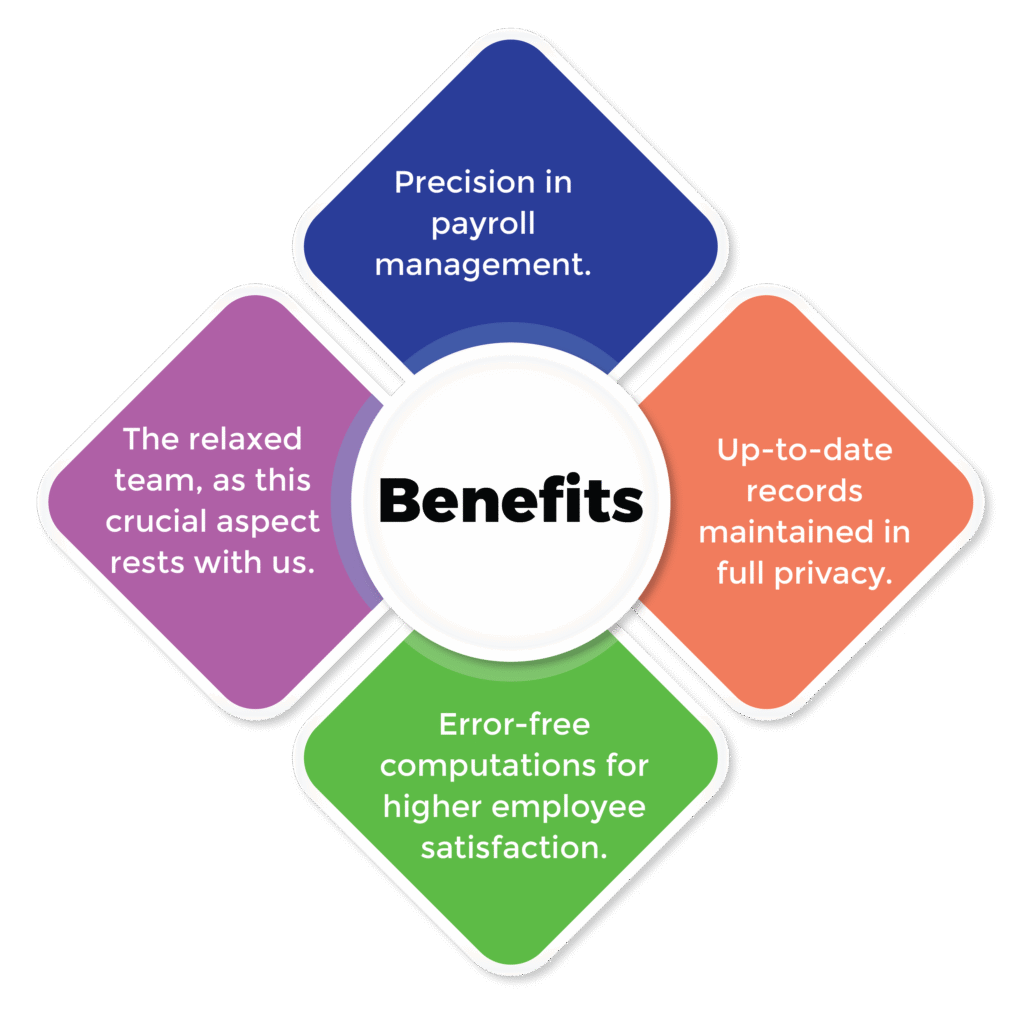

Payroll compliance assists in making sure that the payroll processes of the organization are complying with the rules and requirements of the law. This consist of paying your employees correctly, timely filing of taxes and obeying the labor regulations to avoid hefty number of fines as well as legal repercussions.

To avoid any kind of legal consequences and to maintain the trust of the staff personnel, it is essential to have payroll compliance management. Payroll compliance management takes care of secure and timely payroll processing. It also takes care of the employment laws and tax requirements compliance.

The services include core payroll processing, computation of tax and filing of tax returns, statutory reporting and seeing how the employee/staff personnel get advantages in compliance with audits. The entire process is to ensure that payroll activities comply with the legal and regulatory requirements.

Payroll compliance services ensure lowering the error rate, streamline payroll processes, and guarantee legal compliance. Through the Payroll compliance services, the organizations can focus on their core duties while reducing the risk of non-compliance and other related fines by Payroll compliance outsourcing.

By guaranteeing correct wage calculations, on-time tax submissions, and compliance with labor rules, payroll compliance management supports legal compliance. By taking proactive steps, businesses can prevent hefty fines, litigation, and other legal problems while fostering a stable and law-abiding workplace.