ESIC Act Implemented in Nine Districts of Nagaland from 1 November 2025

Introduction

The Ministry of Labour and Employment has officially extended the applicability of the Employees’ State Insurance (ESIC) Act, 1948 to nine additional districts in Nagaland. This significant move marks another milestone in expanding India’s social security network to benefit more workers and their families.

With effect from 1 November 2025, the ESIC Act will apply to the entire areas of the following districts: Tuensang, Mon, Phek, Kiphire, Peren, Longleng, Shamator,Noklak, and Meluri.

Legal Basis

The notification has been issued under the Employees’ State Insurance Act, 1948 (Act No. 34 of 1948), covering key provisions such as:

- Sections 38–43: Compulsory registration and contribution by employers and employees.

- Sections 45A–45H: Assessment, inspection, and penalties for non-compliance.

- Sections 46–75: Medical, sickness, maternity, disablement, and dependants’ benefits.

- Section 76 (2–4): Constitution and powers of ESIC Courts.

- Sections 82–83: Legal protection for officers and exclusion of civil court jurisdiction.

Key Employer Responsibilities

Every establishment in the notified districts must:

1. Register online on the ESIC portal and obtain an ESIC Code Number.

2. Enroll all eligible employees (earning up to the prescribed ₹21,000 wage limit, or ₹25,000 for employees with disabilities).

3. Deduct 0.75% employee share and contribute 3.25% employer share of gross wages.

4. File ECR (Electronic Challan-cum-Return) and remit contributions on time.

5. Display ESIC information notices in English and local languages.

6. Maintain attendance, wage, and contribution records for inspection.

7. Ensure contract labour coverage under ESIC.

8. Integrate ESIC deductions from the first wage period beginning on or after 1 November 2025.

Benefits to Employees

The ESIC extension guarantees multiple benefits, including:

🏥 Medical Benefit: Full medical care through ESIC dispensaries and hospitals.

💰 Sickness Benefit: 70% wage compensation during certified illness (up to 91 days).

🤰 Maternity Benefit: Paid leave during confinement or miscarriage.

🏥 Disablement Benefit: Financial support for employment-related injuries.

👨👩👧 Dependants’ Benefit: Monthly pension to dependants of deceased insured persons.

⚰️ Funeral Benefit: Lump-sum funeral expense assistance.

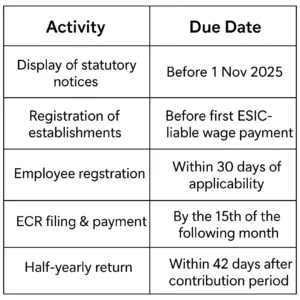

Compliance Timeline

Impact on Nagaland’s Workforce

This notification brings thousands of workers under the ESIC social security net, providing affordable healthcare and insurance protection. It aligns with the government’s mission of “Universal Social Security Coverage” and strengthens labour welfare in India’s North-East region.

Employers must act promptly to register and align payroll systems with ESIC requirements to ensure timely compliance.

Frequently Asked Questions (FAQs)

Q1:From when will ESIC deductions start in Nagaland?

👉 From the first wage period commencing on or after 1 November 2025.

Q2:Are contract employees covered?

👉 Yes, principal employers must ensure ESIC coverage for contract and outsourced workers.

Q3:What happens if an establishment doesn’t register on time?

👉 Delay or default can lead to interest, damages, and penalties under Sections 85 & 85A of the ESIC Act.

Q4:Can existing employees be registered after 1 November 2025?

👉 Yes, but contributions and benefits will apply prospectively. Early registration is recommended.

Conclusion

The implementation of the ESIC Act across nine new districts of Nagaland reflects the government’s commitment to inclusive growth and social protection. Both employers and employees are encouraged to seize this opportunity to enhance workplace welfare and secure long-term benefits.